- A fit for purpose, predictable commercial framework for de-carbonisation is necessary to accelerate investment decisions and to deliver on the oil and gas industry’s de-carbonisation goals.

- The legal framework needs to be up to date in order to not slow down the green shift.

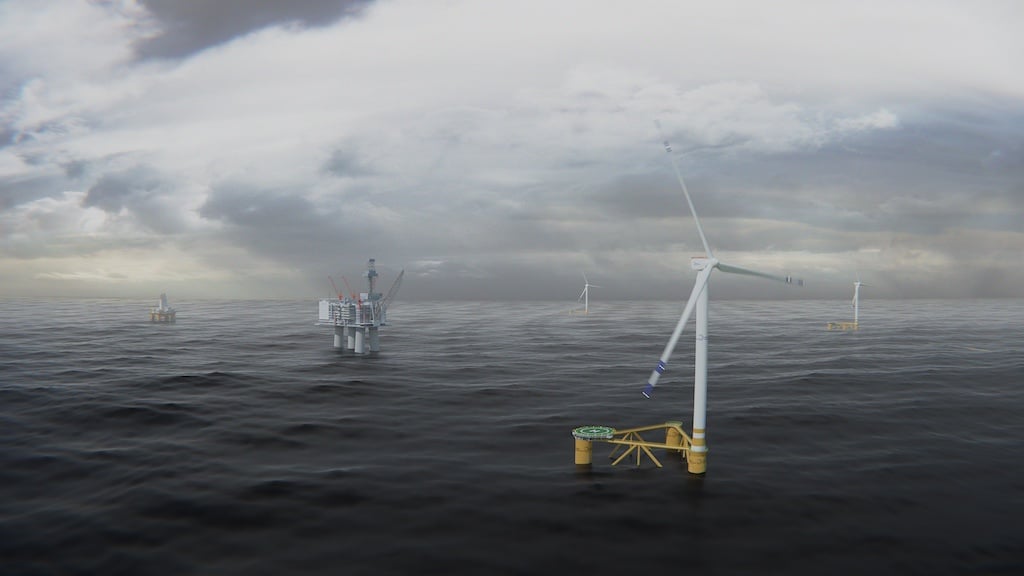

- Mobile offshore wind can be an efficient de-carbonisation solution for oil and gas.

The Norwegian legal and commercial framework has been an enabler for de-carbonisation projects on the Norwegian Continental Shelf. The recently announced commitment by the Norwegian government to a linear increase of the CO₂ tax to NOK 2,000/tonne within 2030 reduces risks and uncertainties in business cases for de-carbonisation.

In addition, investment support from the NOₓ fund, which is awarded based on NOK/kg NOₓ removed per year, provides an efficient funding source for green projects. Pre project and full scale demonstration grants from entities like the state owned ENOVA fund has contributed to both maturing business cases and realising challenging investment decisions.

As an example, the Hywind Tampen floating wind park to power the Gullfaks and Snorre fields on the Norwegian Continental Shelf received a grant from ENOVA equivalent to 45% of the capital investment. This project will make an important contribution to not only de-carbonisation of the oil and gas industry, but also to lower the cost of floating wind power in general.

Although we see several countries setting substantial emission targets, we have yet to see corresponding legal and commercial frameworks to such a degree that they enable investments of meaningful scale in de-carbonisation. Hence, there is a clear lack of measures to realise the stated ambitions to reduce emissions on a global level.

The muscle of industrial capitalism is probably one of the strongest tools we can mobilise in the fight against climate change. Experience from Norway shows that if the incentives are tuned right, funds will be reallocated and investment decisions will flourish, also for green investments.

Our legacy, our philosophy, and our potential

Odfjell Oceanwind is a Norwegian company specialising in floating offshore wind, with origins in the Norwegian offshore wind and maritime community through Sway and the drilling contractor Odfjell Drilling. Odfjell Drilling has been an asset owner for 50 years, holds a leading global position as an operator of mobile offshore drilling rigs, and has strategic partnerships with clients like Equinor, TotalEnergies, BP, Aker BP, Wintershall DEA and Neptune Energy.

During the last few years, Odfjell Drilling has had an active emission reduction strategy for its rig fleet. With funding from the Norwegian NOₓ fund, the company has made large, commercially based investments to de-carbonise their drilling rigs. New technologies for hybridisation of the power systems have been developed and implemented. Combined with operational efficiency measures, the Odfjell Drilling rigs are now the most emission effective in the market.

Based on the knowledge gained in these de-carbonisation projects, we see what is required to endorse investments that reduce emissions. Not just because it is required, but because it is simply good business. To say it bluntly: If the drilling rigs where operating in any other country than Norway, it would have been very difficult to allocate the capital required for these investments.

- Read more: Why a MOWU is such a great idea

Floating wind can be instrumental as a de-carbonisation solution for the offshore oil and gas industry

Odfjell Oceanwind has a long-term ambition to take a leading global position within floating offshore wind, similar to what our sister company Odfjell Drilling has in the floating offshore drilling market. The shorter-term ambition, to provide electrification of oil and gas installations with our Mobile Offshore Wind Units (MOWUs), will be the foundation for further growth.

Several of our projects in Norway have reached key decision milestones with clients, and we are on track for providing electricity to oil and gas installations in 2024.

Based on what we learned in Odfjell Drilling’s rig hybridisation projects, we have developed a solution for integrating wind power into oil and gas installations. This DNV verified solution called WindGrid™ has a potential to provide up to 70% emission reduction compared to electric power generation with traditional gas turbines.

As a comparison, the non-fossil content of the European electricity grid is currently approximately 65%. We believe offshore wind is an attractive de-carbonisation solution for offshore oil and gas, and our ambition is to bring our MOWU solution to oil and gas fields worldwide. To enable this, it is critical that both commercial and legal frameworks are in place.

Due to offshore wind and floating wind power and MOWUs being new solutions to the oil and gas industry outside Norwegian waters, they will operate in unchartered legal territory with little or no precedence. When developing wind power projects together with our clients around the world, we observe that permitting is an uncertainty that must be clarified by legislators.

We consider the MOWU to be similar to connecting a floatel or drilling rig to a host facility with similar permitting requirements. A temporary MOWU powering one specific oil and gas installation that is not connected to a larger electricity grid, should not be confused with larger, permanent and grid connected wind-farm development that in most jurisdictions will require a separate wind power license.

Efficient and fit-for-purpose permitting processes will facilitate accelerated de-carbonisation of oil and gas fields, and ensure that this sector can contribute significantly to reducing emission targets already from 2024.

Through feasibility studies and business case evaluations performed jointly with our clients globally, we have gained a unique knowledge about what it takes to make floating offshore wind part of the solution for de-carbonising the oil and gas sector.

It is apparent that floating offshore wind has a role to play in the industry’s energy transition, and that the Norwegian framework has proven to have many of the right ingredients to enable investments in the green shift.

Our recommendations for accelerating the de-carbonisation of oil and gas fields

Based on our experience of what has worked for our sister company Odfjell Drilling and what we see work in Norway, we recommend the following measures to be implemented by countries that wants to accelerate the de-carbonisation of their oil and gas industry:

- Predictable CO₂ taxes: predictable future CO₂ taxes will strengthen the competitiveness of renewable energy versus electricity generated from fossil fuels, and will be the main driver for the energy transition. Set at the right level, this will enable investment decisions based on pure commercial terms.

- CO₂ fund: CO2 taxes should be paid back to the industry in the form of investment support for de-carbonisation projects. A predictable norm factor based on realised emission reductions (e.g. NOK/tonne CO2 removed), similar to the Norwegian NOx fund, will allow emitters to make qualified and efficient investment decisions. A link to the actual removed CO2 will direct capital to where the effect is greater.

- Innovation grants: use innovation grants to stimulate early movers who are willing to take the risk of developing and implementing new solutions and technologies. Vehicles similar to ENOVA in Norway can provide funding to realise commercially marginal projects categorized as immature technologies.

- Fit-for-purpose regulations: do not let legacy regulations stand in the way for implementing de-carbonisation solutions. In our case, it would mean that we allow MOWUs to connect to installations based on the same regulations as other mobile assets (drilling rigs and floatels).

Read more: Debunking some myths about offshore wind’s role in the energy transition