- UK and Norway have set ambitious targets for reducing emissions from their oil and gas activities

- Both nations desire to develop their respective industries into global leaders in floating wind

- Floating wind is a de-carbonisation solution that could deliver on the emission reduction targets

- Tax incentives could be an effective fiscal tool to incentivise de-carbonisation projects

In the article What is required to accelerate de-carbonisation of the oil and gas industry? from October 2021, we discussed how a fit for purpose, predictable commercial framework for de-carbonisation is necessary to accelerate investment decisions and to deliver on the oil and gas industry’s de-carbonisation goals. Further, how the legal framework needs to be up to date in order to not slow down the green shift, and that Mobile offshore wind can be an efficient de-carbonisation solution for oil and gas.

A few weeks later, we also quoted the president for COP26 and Minister of State at the Cabinet Office, Alok Sharma, who put the situation very well into context with this statement ahead of the COP26 conference and addressed the fact that We cannot wake up in 2029 and decide to slash emissions by 50% by 2030. In this article we reiterated that the UK and Norway have set ambitious emission reduction targets for 2030 and that offshore floating wind had been identified as the key tool to de-carbonise the oil and gas industry in both countries. However, we were also clear that policymakers must enable the floating offshore wind industry to deliver on these targets.

As discussed in the above articles, there are several measures that the government can take in order to realize de-carbonisation projects like floating wind. In this article we will take a closer look at how Norway and UK have looked to incentivize de-carbonisation projects through the tax system.

Norwegian tax package: same incentive for all projects sanctioned within 2022

The Norwegian petroleum tax system has been relatively predictable and symmetrical over the last decades with a 78% tax rate. In order to ensure that projects that are profitable before tax also remain so post tax, an additional uplift rate of 22% of CAPEX have been granted to the E&P companies. This uplift can be seen as a compensation for the time delay in recovering the tax depreciations over six years.

Following the COVID-19 outbreak, there was a major concern in Norway that investment activity within the E&P industry could be reduced by more than 50%. Oil prices fell to record lows and in general there was a pessimistic outlook. In April 2020, when oil prices were plummeting due to the pandemic, the Norwegian government was quick to announce a new tax package to maintain the activity in the O&G sector and to stimulate new investments. Another and equally important target was to facilitate the green transition. The tax package implied that most tax depreciations could be recovered within the first year, plus an increased uplift rate up to 24%. In combination, this ensured an asymmetrical ~91% recovery where most of the recovery was immediate. These rules would be temporary and apply for projects sanctioned within a deadline of end 2022. Although the tax package also applied to decarbonisation projects, there was no distinguishment between the two types of projects or any additional benefit for green projects. Further, the tax package was a pure incentive and was not accompanied by increased taxes on E&P companies.

From an activity perspective, the tax package was a huge success. 24 PDO`s (Plans for Development and Operations) with a total investment size of 300 billion NOK (~25billion EUR) where delivered to the Ministry of Petroleum & Energy during 2022. Interestingly, although the tax package in principle improved the economics also for decarbonisation projects such as floating offshore wind, the benefits for E&P projects were far higher. Hence, although several decarbonisation projects with floating wind were considered for the tax package, all were either postponed or stopped as capital, resources and supply chain were diverted to ensure that more profitable E&P projects would reach the PDO deadline.

In the meantime, the oil prices surged back to pre-covid levels and higher, partly as a consequence of the energy crisis following the war in Ukraine. A few months before the deadline, the government made a slight reduction in the incentive to reflect that the market conditions had significantly changed since the tax package was implemented.

Following the 2022 tax package, Norway has implemented a symmetrical cash tax system where 78% of CAPEX incurred is recovered the year after incurrence.

UK tax package: windfall taxation measure combined with stronger de-carbonisation incentive for CAPEX spent within March 2028

The UK has taken a quite different approach than Norway in terms of the tax system. First of all, while Norway introduced an incentive in the downturn, the UK introduced a windfall taxation measure under the EPL (Energy Profits Levy) in May 2022 as a consequence of the upturn from rising oil and gas prices. The headline tax rate was increased from 40% to 65% in May overnight, and then with an additional 10% to 75% in the updated EPL announced in November 2022. This brought the headline tax rate close to the Norwegian tax rate and all with effect from January 2023. Hence, it affected investments already done in comparison the Norwegian tax package that only targeted future projects. This represented quite a transfer of value from the E&P companies and to the state and according to OEUK, over 90% of the E&P operators have cut spending, and there is a risk of significant activity reductions.

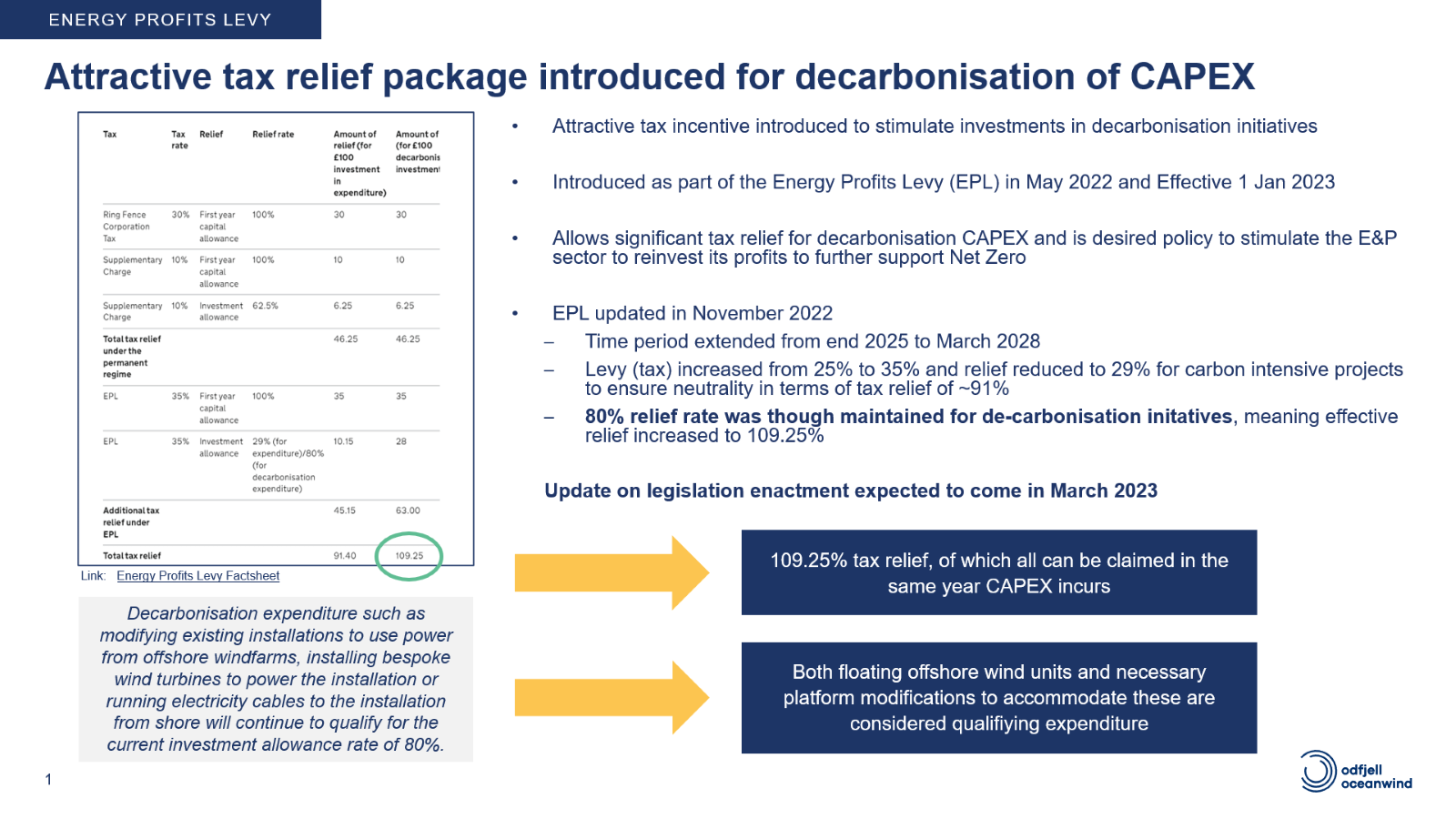

Contrary to in Norway, the UK government put in place an attractive temporary investment incentive under the EPL where de-carbonisation projects have higher tax depreciation rates (109.25%) than E&P investments (91.4%). This is further described in Figure 1 below.

Figure 1 The investment incentive under the UK Energy Profits Levy

Further, the incentive is time capped to March 2028 to ensure some sense of urgency in implementing de-carbonisation initiatives. Hence, a good way to use the tax system to both drive and accelerate future desired behaviour towards de-carbonisation projects like floating offshore wind, which is specifically mentioned as a qualifying measure in the EPL.

In isolation, the investment incentive under the EPL is considered a highly effective tool to stimulate and de-risk decarbonisation investments and also to reward early movers within the relatively immature industry of floating offshore wind. However, there are concerns that the fallout from the windfall taxation effectively blocks most of the potential investments that this incentive could have yielded. Hence, all sides of the equation need consideration when creating effective tax systems for incentivizing de-carbonisation.

Conclusion

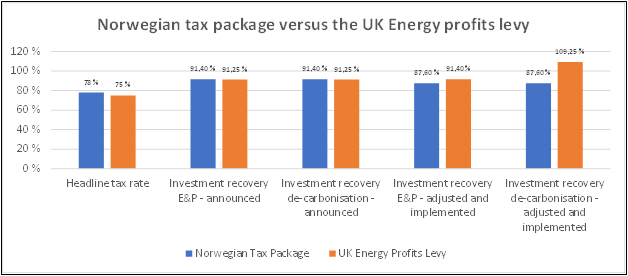

The tax system could be an effective tool to achieve de-carbonisation projects, if applied right. In general, we believe that the Norwegian approach with stimulating investments, without penalizing, is the right conceptual approach to drive desired behaviour. Further, we believe that the UK has found a good way to distinguish between de-carbonisation and E&P projects in the design of the incentive, and in particular after the investment recovery adjustment up to 109.25% was made in November last year for decarbonisation projects only. The relatively large difference between investment recovery levels of 109.25% vs. the headline tax rate of 75%, combined with the fact that investment recovery is at levels above 100%, makes the UK investment incentive for de-carbonisation projects highly attractive by design. However, we believe the rapid and significant changes in tax rates in UK may cause some uncertainty for long term investors.

Figure 2 – UK and Norwegian tax systems for E&P activities compared

Our recommendation is that the tax system is continuously adapted to ensure that investments in de-carbonisation projects are being incentivized. Based on our first-hand experiences, our recommendations to ensure an effective tax system are as follows:

- Predictability: a key topic for investors in assets is long term predictability on regulatory terms. Both E&P and de-carbonisation projects share a common trait of being long term investments with typical 25+ years horizon. This also means that although incentives introduced are attractive, sudden windfall taxation measures on existing assets and investments made under other premises may cancel the effect of attractive incentives introduced, as operators may weigh regulatory risk and uncertainty heavier than potential investment incentives. In short: Desired behaviour should be awarded while prior behaviour (that once was desired), should not be penalised.

- Differentiation: de-carbonisation is considered a desired behaviour and should be rewarded. Hence, there should be relatively stronger incentives to invest in de-carbonisation projects than in E&P projects to ensure de-carbonisation projects are being realised.

- Timing: to ensure rapid deployment, early movers should be rewarded. Hence, there should be tax incentives to accelerate de-carbonisation projects towards the emission target deadlines, e.g the 25% target in 2027 and 50% target in 2030 in UK and Norway`s target of 55% in 2030. Further, the incentive could have a gradual step-down over time to ensure a further incentive for those who take the lead.

- Production: energy security is expected to be a key issue for an unforeseeable future. Hence, investment incentives should be focussed towards decarbonisation initiatives that add energy production.

The Norwegian tax package yielded zero de-carbonisation projects with renewable production. It will be exciting to see how many projects the EPL incentive will yield now that it has been published as part of the Chancellor`s budget statement. The incentive is certainly a move in the right direction and the distinguishment between type of projects was the missing link in the Norwegian tax package.

|

|

Co-author: Jon Barratt Nysæther Jon Barratt is Business Development Manager at Odfjell Oceanwind and formerly leading engineer/business developer for floating wind in Equinor. He has broad technical experience and holds a PhD from Univeristy of Oslo and MSc from NTNU.

|